What are overbought and oversold stocks?

Traders often tend to overreact to news, earnings releases, rumours, and other market-moving events and make abnormally heavy buying or selling, and this carries prices too far in a particular direction. A stock which has risen too much because of excessive buying is considered overbought and a stock which has fallen too much because of excessive selling is considered oversold.

What is this book going to do to you?

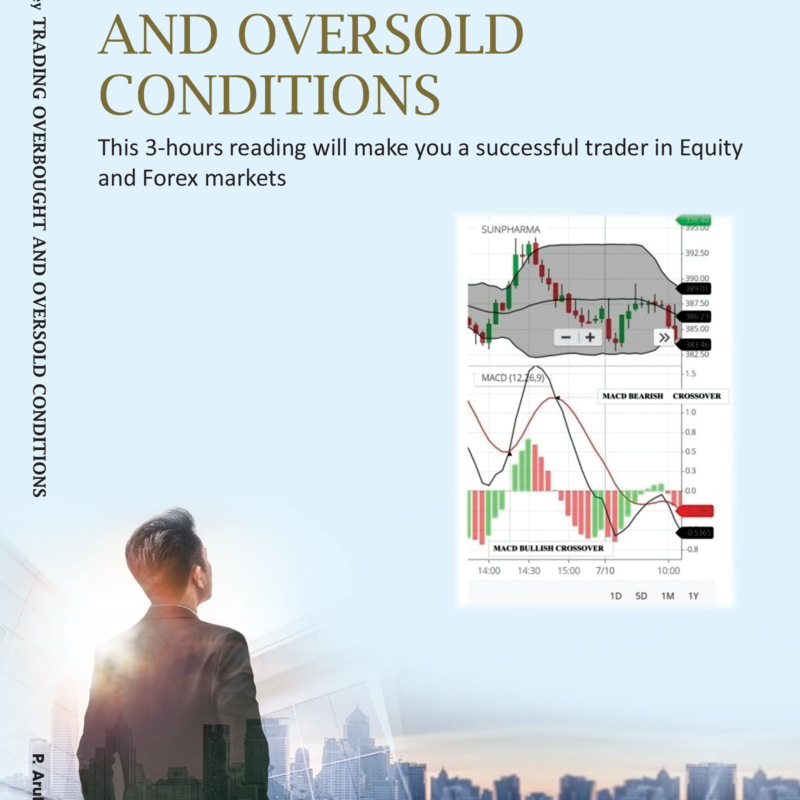

Overbought condition does not mean that the stock has reached the peak and won’t continue going up anymore; it may continue the up move and become more overbought. Similarly, oversold condition does not mean that the downtrend is going to end soon; the stock may continue to fall many more days and become more oversold. We, therefore, have to identify the peaks of markets to go short and the bottoms of markets to go long to take advantage of reversals that occur after overbought/oversold conditions. This book teaches 10 highly reliable technical indicators that help traders identify and respond to trade signals at the right time, especially in overbought and oversold conditions, and earn optimal profit:

How have the technical indicators been selected?

The 10 technical indicators have been carefully drawn from all the categories of technical indicators viz.,

- Trend Indicators

- Momentum Indicators

- Volatility Indicators

- Volume Indicators and

- Support & Resistance Zones Indicators

so that the buy-sell signals provided by these indicators are validated and are highly reliable, and trading at stock, forex, commodity. and cryptocurrency markets based on these signals proves lucrative.

Reviews

There are no reviews yet.